Meal Kits Show The Way For Breakthrough Innovation Opportunities In The Food Category

By Liz Miller, Vice President of Business Development | February 15, 2021

Meal Kits exploded onto the American food scene in 2012 with the launch of Blue Apron, HelloFresh, and Plated, followed by Home Chef a year later. By 2019, the North American market for meal kits had slowly but steadily grown to an estimated 1.7 billion dollars, although companies struggled with profitability and retaining customers. When the COVID-19 pandemic hit, interest in meal kits increased as people found themselves at home, staring into the cupboard, searching for inspiration.

The meal kit industry has faced notable changes and challenges since its birth, including increased streamlining with physical grocery stores, competition from convenience-oriented channels such as the meal kits offered at Amazon Go stores, concerns over sustainability and excessive packaging waste, labor issues, and the constant challenge of high customer acquisition costs paired with low long term retention.

With all the buzz around meal kits in a time of increased at-home cooking, and with so little known about how consumers feel, behave, and think about meal kits, we explored some current trends and sentiments toward the meal kit space. We used Maru/HUB’s proprietary panel and surveying tools to get updated insights on consumers responses to this elusive category.

Meal kits play well to the changing tastes being driven by the younger consumer

Despite all the hubbub about meal kits as a food industry game-changer, use of meal kits remain a relatively niche activity, purchased mainly by younger, university-educated people who enjoy food, are adventuresome in their eating, and like following recipes.

The use of meal kits is something we have been watching for some time; we first measured the use of meal kits back in 2017, and we found that 10% of Americans were current users and another 5% had tried them and stopped. Amid the pandemic, we found the number of users had grown by 50% to 15%, with an additional 11% being lapsed users.

Both trial and usage are hugely generational. Two-thirds of all current meal kit users are 34 and under, suggesting this part of the food business, while slow-growing, may have an increasing share of dollars. And these now young consumers will mature, raising a new generation that will always have meal kits as part of their food repertoire.

The gap between trial and continued usage also varies generationally, with the lapse rate increasing with age. This is just one example of how generational mindsets and other differences in how people feel, and think can directly impact behaviors and outcomes.

While three in ten of the younger cohort are buying meal kits, it is unlikely to become a majority practice, as it is linked to a certain mindset that not everyone shares. Understanding how each group feels and thinks, and how that ties to their behaviors, is an important part of understanding who buys meal kits, why, and who could be a potential acquisition target. “People who regularly cook are flabbergasted that someone would pay a premium to avoid going to the grocery store,” writes Andrew Goble in GQ. “People who regularly order delivery think paying for a box of uncooked ingredients is like paying to be given homework.” And indeed, there is a certain mindset associated with using (and trying) meal kits.

Too many established food brands just don’t care

Food manufacturers are right to keep a wary eye on meal kits and other disruptors. We undertook research using our ‘Brand Emotion’ System 1 technique to unlock parent’s true feelings about food brands across the UK, France and Germany.

Maru’s unique Brand Emotion capability works through the principle of visual semiotics, using a smart, gamified online technique based on a proprietary set of 9,000 images, each validated over 10 years as linked to key emotions. Parents build a collage of 10 images, that best reflect their intuitive feelings. This gamified image selection is much more revealing, honest, and accurate than simply asking them to give us slow rational responses to traditional rating scale questions.

From this image selection, we generate an emotional signature of how food brand communications make them feel. It reveals that brands are over-relying on desire and instant gratification.

The top emotions reveal that food brands currently communicate an underlying sense of enabling parents to provide and care for their families, (Nurturing emotion). But they also create a desire and temptation for instant and frequent consumption (Seductive and Dynamic emotion).

Parents react well to being able to provide what their children desire, but they feel this is sometimes at the expense of the product itself. Verbatim comments indicate brands are sometimes nutritionally poor and create a sense of guilt, leaving parents feeling unfulfilled in their duties. This delicate balancing game of what children desire vs. what’s healthy for them is destabilized by conflicting pressures from children, peers and media communication. In a nutshell, food for parents is a hugely emotive construct.

We used Brand Emotion to ask parents what the ideal communications from food brands should feel like–what’s the ideal emotional signature? By establishing both the current and ideal emotional signature, we’ve unlocked an emotional pathway on how to meet their wider emotional needs. It revealed the ideal communication needs more than just desirability. It needs to show care and nurturing.

The ideal emotional signatures reveal parents have no problem with food brands being marketed as alluring and desirable items – the Seductive emotion is prevalent here. However, parents want more emotional reassurance about the brand’s credentials and integrity (Capable/Competent emotion), focusing on ingredients and wider social or environmental impact.

Parents need to feel that thought and care (Nurturing emotion) has gone into the selection of ingredients and the manufacturing process. These need to transcend mere consumption and meet a deeper need of ‘Is the brand good for me, my family and even my wider community/society’? Of course, food brands know this but what our Brand Emotion technique can reveal is the true emotional signature of your brand, communication, packaging or any piece creative to truly understand what the stimulus is really communicating to consumers – constantly checking if your development and marketing activity is hitting the desired emotional sweet spot.

Stimulating the inner chef mindset is an opportunity to drive growth

Those who have used meals kits are much more likely to “consider myself adventurous when it comes to food.” And they are more likely—especially current users—to think of themselves as a “creative cook.” The variety that meal kits offer appeal directly to this desire for adventure and creativity.

And companies like Blue Apron know it. They say: “We keep dinner interesting. From top-rated favorites and health-conscious options to Premium dishes and more, variety is always on the menu.” The health-conscious aspect of this pitch also speaks directly to the parent’s desire to provide care and nurturing, as uncovered by Brand Emotion. By assembling the meal, they can be sure of the quality and healthfulness of the ingredients and be assured that they are a good provider.

Meal kit subscribers also like the structure that comes with a meal kit. Users are much more likely to agree that they “enjoy cooking if someone gives me a recipe to follow.” Convenience is another factor. Users are also more likely to say they “enjoy cooking but don’t enjoy all the prep work of sourcing ingredients.”

The specific nature of this mindset suggests a limit to the appeal of meal kits. But, given the age skew, grocery stores and restaurants should continue to watch this category to see if this behavior stays firm as current meal kit customers age. It’s an important spending category for younger shoppers and should be watched carefully in the years to come.

Innovation in product configuration is shaping the success of brands in growth

In the world of meal kits there is tremendous opportunity to configure offers to deliver on both messages of caring and desirability. That’s why manufacturers and grocers are turning to our Concept Connection solution to help them with their innovation.

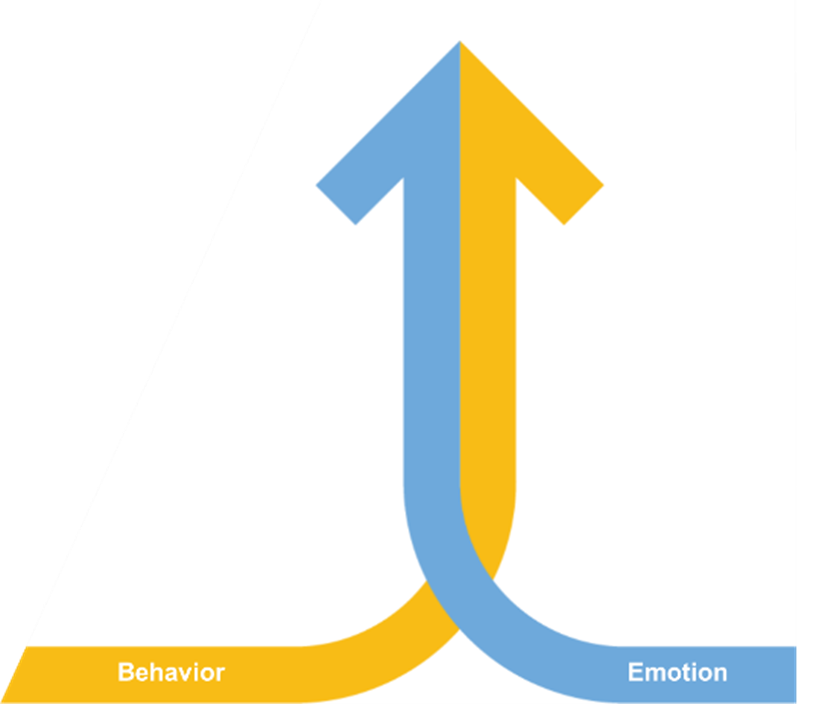

Concept Connections utilizes a range of integrated System 1 and System 2 proprietary tools to accurately measure emotional and behavioral response to stimuli, helping researchers and marketers to close the gap between what consumers say and what they do. It employs all aspects of our Feel. Behave. Think framework.

It incorporates Brand Emotion and Implicit Association Testing to understand how consumers implicitly and emotionally connect to the concept. This tells us how they feel. We learn how they will behave by incorporating Maximum Differential scaling, asking people to make trade-offs between elements of the concepts. And lastly, we measure how people think by utilizing scalar attitudinal tools.

This combination enables us to holistically understand consumers, by covering all aspects of their connected experience to the concept. Utilizing this approach, we provide insights to both understand and close the consumer Say/Do gap.

Intersection of Behavior and Emotion is key to understanding sector and identify growth opportunities

Concept Connection epitomizes how we are uniquely positioned at the intersection of behavior and emotion. By evaluating research issues through both System 1 and System 2 lenses we provide a connected and holistic view of consumer response.

This approach allows us to best partner with your organization to explore opportunities, refine ideas and achieve commercial success. Those with the best insights win!

So much opportunity

While the meal kit space is one fertile area for innovation, there is so much more opportunity. Our recent whitepaper Future of Food: 3 Emerging Themes for Grocery, Manufacturers and Restaurants details some of the ways in which the pandemic has caused disruption that leads to openings. It explores three key themes that have emerged from our recent research on people and food. They suggest abundant possibilities for grocery, manufacturers, and restaurants:

The transformation of our relationship with food blows open the door to grab market share through innovation

There is a segment we identified that are perfect targets for testing new ideas

Reimagining the restaurant means upping the allure and fun

Download it to learn more.

Watch this blog for more of our ongoing series on the future of food or contact us to learn more about what we’re exploring. To ensure you don’t miss an installment you can subscribe to our articles here.

Bon Appetit!

*This article contains important input from Maru/Matchbox UK’s Steve Brockway and Anjul Sharma.